In recent years, social media platforms like TikTok have become breeding grounds for viral trends, some harmless and entertaining, others insidiously harmful. One such trend that has gained traction is the 'Girl Math' phenomenon, which, despite its seemingly innocuous nature, perpetuates damaging stereotypes and undermines women's financial literacy. In this article, we delve into why the 'Girl Math' trend is toxic and harmful.

Image Source: Buzzfeed.com, Lead Image Source: themarysue.com

The Dark Side of The ‘Girl Math’ Trend

Reinforcing Stereotypes

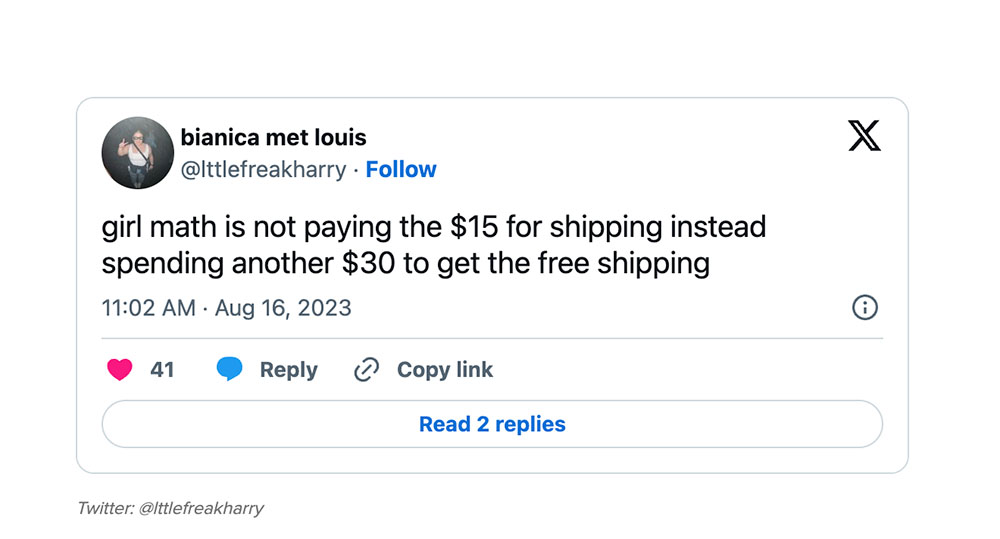

The essence of the 'Girl Math' trend lies in the trivialisation of women's financial decision-making, attributing irrational spending habits to gender. This includes content that jokingly justifies irresponsible purchases using illogical logic, under the guise of 'Girl Math.' By framing these behaviours as inherently feminine, the trend reinforces harmful stereotypes that women are frivolous with money and lack the ability to make sound financial decisions.

Image used for representational purposes only.

Undermining Financial Literacy

Beyond perpetuating stereotypes, the 'Girl Math' trend contributes to the erosion of women's financial literacy. By framing irrational spending habits as a humorous quirk rather than a serious issue, the trend normalizes irresponsible financial behaviour. This normalisation can lead to detrimental consequences, as individuals, particularly young women, may internalize these messages and adopt similar spending habits without fully understanding the implications.

Image used for representational purposes only.

Gendered Messaging and Self-Esteem

The use of the term 'Girl Math' not only perpetuates stereotypes but also undermines women's self-esteem. Labelling irrational financial decision-making as 'girl' behaviour implies incompetence and inferiority, further reinforcing societal messages that women are less capable in areas traditionally associated with masculinity, such as mathematics and finance. This gendered messaging can have a profound impact on women's confidence and self-perception, exacerbating imposter syndrome and discouraging them from pursuing financial education and empowerment.

Image used for representational purposes only.

Promoting Irresponsible Behaviour

While the 'Girl Math' trend may be intended as light-hearted entertainment, its underlying message promotes irresponsible financial behaviour. By trivialising concepts such as budgeting, saving, and investing, the trend encourages viewers to prioritize short-term gratification over long-term financial stability. This can perpetuate a cycle of financial dependency and exacerbate existing gender disparities in wealth accumulation and financial independence.

Reel Vs Real: Women Prove To Be Great With Money

Contrary to the ‘Girl Math’ myth doing the rounds, women prove to be financially sound and smart. So says numerous studies which highlight women as the more responsible candidates for financial know-how.

Image used for representational purposes only.

Fibe, a fintech platform recently published research highlights that suggest that women were 10 per cent more likely to make their timely EMI repayments in comparison to their male counterparts. A recent DBS Bank-CRISIL survey also shared results that pointed towards women as low-risk investors with women earning in metropolitan areas allocating 51 per cent of their funds to fixed deposits as well as savings accounts. The distribution also listed 16 per cent in gold, 15 per cent in mutual funds, 10 per cent in real estate, and seven per cent in stocks. According to a FinEdge report, women also outpaced men as investors, with an average single SIP investment of ₹ 4,483 compared to men's ₹ 3,992.