The fact that women have been able to make a mark in many fields in recent decades, no matter which part of the world they belong to, is pretty well known. From politics to scientific research, you’re likely to find women leaders in most professions. However, if there is one industry which is still plagued by a comparatively low presence of women achievers, it is finance.

Are women in finance underrepresented?

The World Economic Forum’s Global Gender Gap Report 2021 found that reduced business hours and activities over the last year have only widened the gender gap between men and women, especially in the finance industry. Countries like India, where the economic participation gender gap has increased by three percent, have been especially hard hit. Clearly, overcoming the gender gap and bringing about gender parity is crucial for not just individual companies but for entire economies.

Much of this imbalance in representation is caused by factors like institutional and policy inertia, outdated organisational structures, discrimination – especially on the basis of pre-conceived notions like women “just aren’t hardwired to get numbers or finance” – and socially limiting work cultures. To break these barriers in the finance industry, an economy not just requires intervention at the level of policy but also a change in how young women are taught to plan their career trajectories.

However, despite these barriers in making it to the top echelons of the finance sector, there is a slow-yet-steady increase in women leaders in the field of finance, especially globally. Some of the top financial leaders in countries like the USA--which have worked for decades to bring about a change in pre-conceived ideas about women in finance, even on Wall Street—are currently women.

So, while women still have a long climb ahead in the global finance industry, quite a few women have not only made it to what was considered to be an “all-boys club”, but are currently leading it. These are the most powerful women in finance, globally, you should definitely look towards for inspiration.

Ana Botin

There’s good reason why Ana Patricia Botin, a Spanish businesswoman and banker, not only made it to the eighth rank on Forbes’s 2020 Most Powerful Women list, but is also considered to be the most powerful woman in the finance industry. Born to Spanish banker Emilio Botin, Ana Botin started her career at JP Morgan in the 1980s and worked her way up to becoming the chair of her father’s company, Banco Santander, in 2014. In 2015, Botin was made an honorary Dame Commander of the Order of the British Empire for services to the British financial sector, especially during the tenure of British PM David Cameron. Botin is perhaps best known for her 2017 coup, where the Banco Santander bought the failing Banco Popular for the (staggeringly low) amount of one Euro, and then became the largest bank in Spain.

Abigail P Johnson

Popularly known as one of the richest financial investors in the world, Abigail Pierrepont Johnson is the president and CEO of Fidelity Investments, and the chairman of Fidelity International, since 2014. Her net worth is roughly around 22.4 billion dollars, which also makes her one of the richest women in the world. Even though Fidelity Investments was run by Johnson’s family, this Harvard Business School graduate made a slow and thorough way up the ranks of the company since first joining it as an Equity Analyst in 1988. Over a career spanning three decades, Johnson has proved that finance can clearly be the domain of women. This is especially evident in the way she has steered Fidelity Investments away from failing practices like open-end mutual investments and embraced crypto currency as well as venture capital. Within the first year of (wo)manning the wheel of the company, the changes brought about by Johnson secured the company profits in excess of five billion dollars.

Jessica Tan

In 2019, Jessica Tan made it to the third spot on Fortune’s Most Powerful Women International list. In 2020, she was ranked 21st on Forbes’s Power Women 2020 list. The reason why this 45-year-old MIT graduate in electrical engineering is considered a big name in the finance industry is due to her contribution in updating and running China’s largest insurance company, the Ping An Group. This Singaporean woman began her career at the US consulting firm McKinsey and first collaborated with her current company during a project in Singapore. She joined Ping An in 2013 and has been its co-CEO since 2018.

Mellody Hobson

She was director of Starbucks Corporation since 2005 (and its Vice Chair since 2018), director of The Estee Lauder Companies Inc from 2005 to 2018, director of DreamWorks Animation SKG from 2004 to 2016, and the co-CEO of Ariel Investments, an American investments management firm since 2019. If that’s doesn’t read like the resume of one of the most powerful women in finance, we don’t know what is. Many might know Mellody Hobson as George Lucas’s (of Star Wars fame, if you needed the reference) wife, but her illustrious career as a leading woman in the finance industry clearly deserves a round of applause, if not a standing ovation.

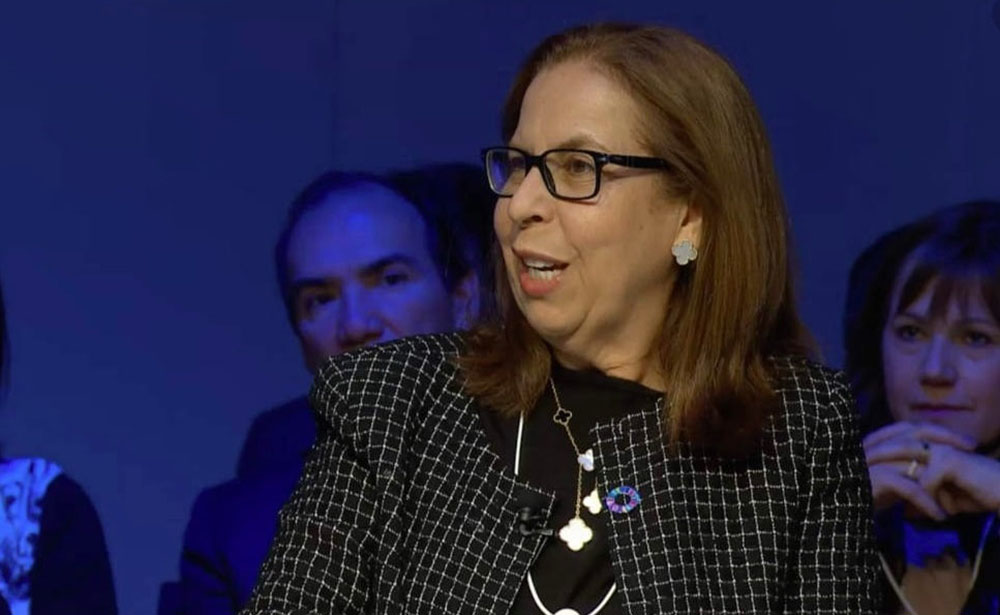

Afsaneh Mashayekhi Beschloss

As the founder and CEO of RockCreek—a global investment firm which focuses on socially responsible investments in much-needed areas such as renewable energy, education, and affordable housing—since 2003, Afsaneh Mashayekhi Beschloss’s story is as much about becoming a powerful woman in the finance industry as it is an American immigrant-success story. Born in Iran, Beschloss studied economics at Oxford University and went on to work for UK- and US-based companies like Shell International, JP Morgan, and the Carlyle Group.

Her most well regarded contributions, however, were made during her work at the World Bank throughout the ’80s and ’90s. Not only did she lead investments at the World Bank and became an expert on the Global South, she also became its director and chief investment officer in 1997. Between 1999 and 2001, she served as its vice president and treasurer. Beschloss has been bestowed with multiple awards for her contributions, including the Institutional Investor Lifetime Achievement Award and the Robert F Kennedy Ripple of Hope Award.