The prospect of understanding the tax regimes and planning investments can be both arduous and confusing! But set those thoughts aside, immediately. You must take charge of your savings, expenses, investments, and yes, even how you choose to pay your taxes.

At the unveiling of the Union Budget 2023 earlier this week, the Union Finance Minister Nirmala Sitharaman announced a number of changes in the new tax regime making it the default one. Not only does it simplify the process of understanding and paying tax, but it also provides relief on several fronts in terms of lower tax rates. However, you can always choose to stick to the old tax regime for the time being if that works better and review your choice after a year. Now for the question on everyone’s mind - if the new tax regime is so attractive, why would you choose to stick to the old one?

Yamuna Inder, a private banker in a nationalised bank lists out the pros and cons of the new and old regimes. “A new tax regime is in place, but the good part is that you can exercise choice and still choose to follow the old regime if it makes sense to you. Every woman is different, with varying earnings, expenses, investments, and so on. One size does not fit all. There are definitely some benefits with the new regime since tax rates have been lowered. Now, a person earning ₹ 9 lacs per annum will need to pay only ₹45,000 as opposed to ₹ 60,000, while someone earning ₹15 lakh per annum will need to pay only ₹1.5 lakh as opposed to ₹1.875 lacs. Also, there is a rebate on income up to ₹7 lakh, which was earlier only ₹ 5 lacs. The upper class also benefits, since the highest surcharge rate on income above ₹5 crore has been reduced from 37 per cent to 25 per cent. However, there are also some deductions that aren’t allowed under the new tax regime, so one needs to keep that in mind. These include Leave Travel Allowance (LTA), House Rent Allowance (HRA), Deduction for Professional Tax, Interest on Housing Loan, and so on. So, if you’ve got investments like life or medical insurance, home loan repayment, children’s school fees and also want to avail the benefits of LTA or HRA, it might actually be more advisable to stick to the old regime.”

If you’re not sure which option is more beneficial to you, it might be wise to use an online tax calculator or sit down with your auditor to do a comparative analysis. Unless you choose to opt for the old tax regime, the new one will be the default one for most taxpayers.

Says Surajit Bose, former banker with ICICI Mumbai and independent consultant, “The broad objective of a nation’s budget is an indicator of a government’s efficacy in managing its resources to maximise value creation of its citizens. It also holds the administration accountable for actions impacting both the micro and macro environment. However, the most anticipated and debated aspect of the budget always remains the government’s approach to income tax and its impact on the taxpayers of the nation. The new tax regime announced by the FM, prima facie seems to have reduced the burden on taxpayers but it is advisable to take an informed decision. While the standard deduction remains at ₹ 50,000, it is important to assess the new tax regime carefully before you decide which tax regime to adopt.

0 to ₹ 3 lakh - Nil

₹ 3 to 6 lakh – 5 per cent

₹ 6 to 9 lakh – 10 per cent

₹ 9 to 12 lakh – 15 per cent

₹ 12 to 15 lakh – 20 per cent

Above 15 lakh – 30 per cent

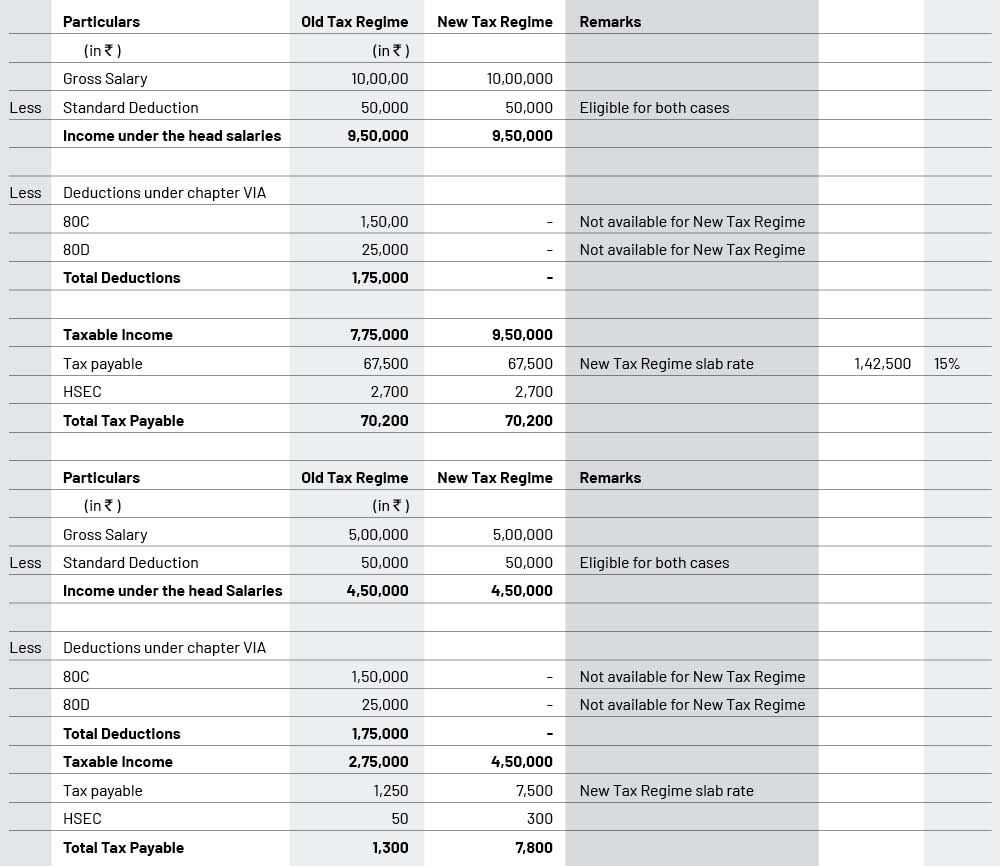

Basis the above slabs, there are two fundamental differences between the current tax regime and the old one. The current tax regime has increased the zero-tax slab from ₹2.5 lakh to ₹.3 lakh. While this has brought joy to taxpayers, the removal of availing a further deduction of ₹1.75 lakh from taxable income under 80C and 80D is a huge dampener. So how does one decide which regime to choose? In my opinion, the new tax regime should be adopted only by individuals with an income of ₹.10 lacs and above. Individuals with salary up to 10 lakh may save more money by continuing under the old regime.”

Bose provides two examples in the tables below, with varying salary levels and a comparison of how taxation impacts them.

In the old as well as the new regime, both men and women are taxed equally and there are no special exemptions for women. While we welcome an equitable world, where all genders are treated equally, the truth is that the same taxation can impact men and women quite differently, especially women who are marginalised. According to a World Bank report published last year, “Recent research suggests that tax systems around the world contain both explicit and implicit gender biases. Removing these biases can make tax systems more equitable and contribute to economic growth by increasing female labour force participation and entrepreneurship. For instance, a well-designed progressive income tax can boost the employment of low-income women, especially with the lenient tax treatment of or subsidies for work expenses such as childcare. Gender differences in taxation do matter, and policymakers can take steps to correct them.”