What began years ago as a blog documenting an experiment in mindful spending and budgeting has now evolved into a popular social media trend. The "No Buy" trend, originally a minimalist movement, has taken the internet by storm. Its premise is simple: reduce unnecessary spending by avoiding non-essential purchases for a set period—whether a month, three months, or even a full year. But why is this trend resonating with so many, and could it be the ultimate gateway to financial minimalism?

The "No Buy" trend isn’t just about saving money; it’s a mindset shift toward intentional living. By curbing unnecessary spending, individuals are discovering a deeper sense of financial independence, environmental responsibility, and personal fulfilment. Whether you’re looking to achieve a specific financial goal or simply want to live more mindfully, the "No Buy" challenge might just be the key to unlocking a more minimalist and meaningful lifestyle in 2025. Are you ready to give it a try? Let’s make financial minimalism the new normal.

The Rise of the 'No Buy' Trend

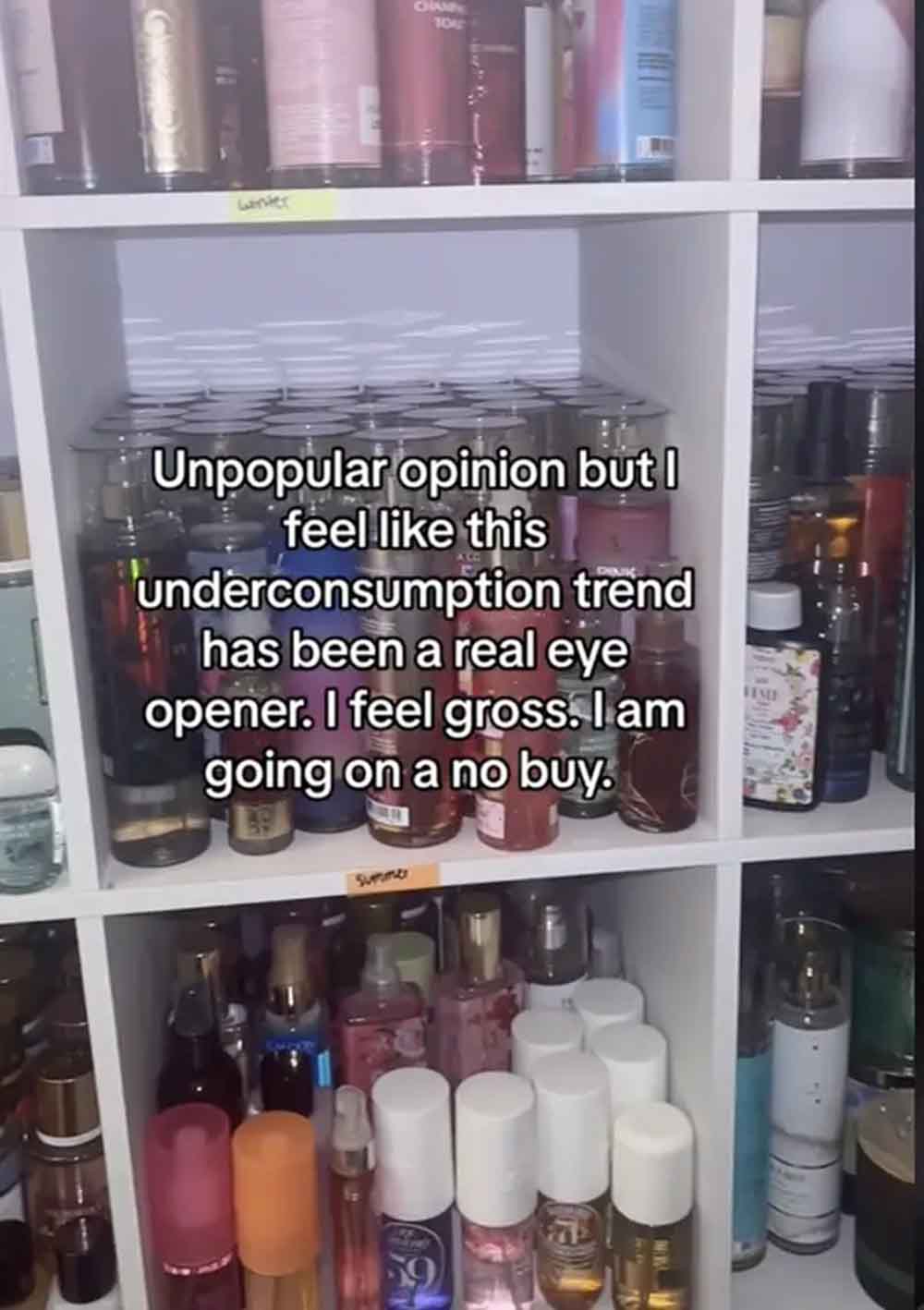

Minimalism has long been associated with cutting back on clutter, but the "No Buy" trend takes it a step further by extending this philosophy to spending habits. In 2025, the movement has gained traction thanks to a perfect storm of factors:

Sustainable Living: With growing environmental concerns, people are questioning their consumption habits and opting for a more sustainable lifestyle.

Financial Wellness: The economic uncertainty of recent years has encouraged many to prioritize saving over spending.

Social Media Influence: Platforms like TikTok and Instagram have become hubs for the "No Buy" community, with influencers and everyday individuals sharing their journeys, struggles, and successes.

Hashtags like #NoBuyChallenge and #FrugalLivingTips have gone viral, inspiring millions to rethink their purchases and embrace intentional living.

How to Start Your Own 'No Buy' Challenge

Want to join the movement? Here’s how to get started:

Set Your Rules: Decide what qualifies as a "non-essential" purchase. Common exclusions include groceries, medical expenses, and essential home repairs.

Choose a Timeframe: Start with a manageable period, like a month, and extend it as you gain confidence.

Track Your Progress: Use a digital budgeting tool or journal to monitor spending and reflect on your journey.

Identify Your Motivation: Are you saving for a big purchase, reducing debt, or aiming for a more sustainable lifestyle? Knowing your “why” will help you stay committed.

What Are the Benefits of the 'No Buy' Trend?

The rewards of embracing this lifestyle go far beyond financial savings:

Increased Savings: Many participants report saving hundreds or even thousands of dollars by cutting out unnecessary spending.

Mindful Consumption: The challenge forces you to evaluate your true needs versus fleeting wants.

Environmental Impact: Reduced consumption leads to less waste and a lower carbon footprint.

Emotional Clarity: Simplifying your spending can help reduce decision fatigue and bring a sense of control over your finances.

Challenges of the 'No Buy' Lifestyle

Of course, no trend is without its hurdles. Here are some common challenges:

Impulse Spending: Breaking the habit of buying on a whim can be tough, especially in a world of targeted ads.

Social Pressures: Navigating birthdays, holidays, and social outings without spending can feel awkward.

Emotional Triggers: Many people use shopping as a coping mechanism, so it’s important to address the emotions driving your spending habits.

Tips for Staying Committed to the 'No Buy' Challenge

Find a Support System: Join online communities or enlist a friend to take the challenge with you.

Replace Shopping with New Habits: Pick up hobbies like reading, cooking, or exercising to fill the void.

Celebrate Small Wins: Reward yourself with non-monetary treats—like a relaxing day off—when you hit milestones.

Remind Yourself of the Big Picture: Keep your long-term goals in mind to stay motivated.