In the world of personal finance, creative savings methods often capture attention, but few have had the staying power of the 52-week savings challenge. First introduced on social media a decade ago by Kassondra Perry-Moreland, a finance enthusiast, this challenge has made a roaring comeback in 2025, thanks to its enthusiastic adoption by Gen Z on platforms like TikTok. Originally popularised on Facebook through a group called "Kassondra's 52-Week Saving Money Challenge," this method was designed with dollar savings in mind. Here, we're making it local for you!

How Does the 52-Week Savings Challenge Work?

The concept is simple yet effective. Over the course of 52 weeks, participants commit to saving an incrementally increasing amount of money each week.

In Week 1, you save ₹50.

In Week 2, you save ₹100.

In Week 3, you save ₹150, and so on.

By Week 52, you’re saving ₹2600 in that week.

At the end of the challenge, you’ll have saved a total of ₹68,900.

The incremental approach makes it feel manageable, especially in the early weeks, and by the time the larger contributions roll around, many participants have already adjusted their spending habits to accommodate the savings. For an added twist, some individuals reverse the order—starting with ₹2600 in Week 1 and decreasing to ₹50 in Week 52—to front-load the heavier savings early on.

How to Stay on Track with the Challenge

Set a Savings Goal: Decide in advance what you’re saving for, whether it’s an emergency fund, a vacation, or a new gadget. Having a purpose can keep you motivated.

Automate Your Savings: If your bank allows it, set up an automatic transfer to a dedicated savings account each week. This minimises the risk of forgetting or skipping contributions.

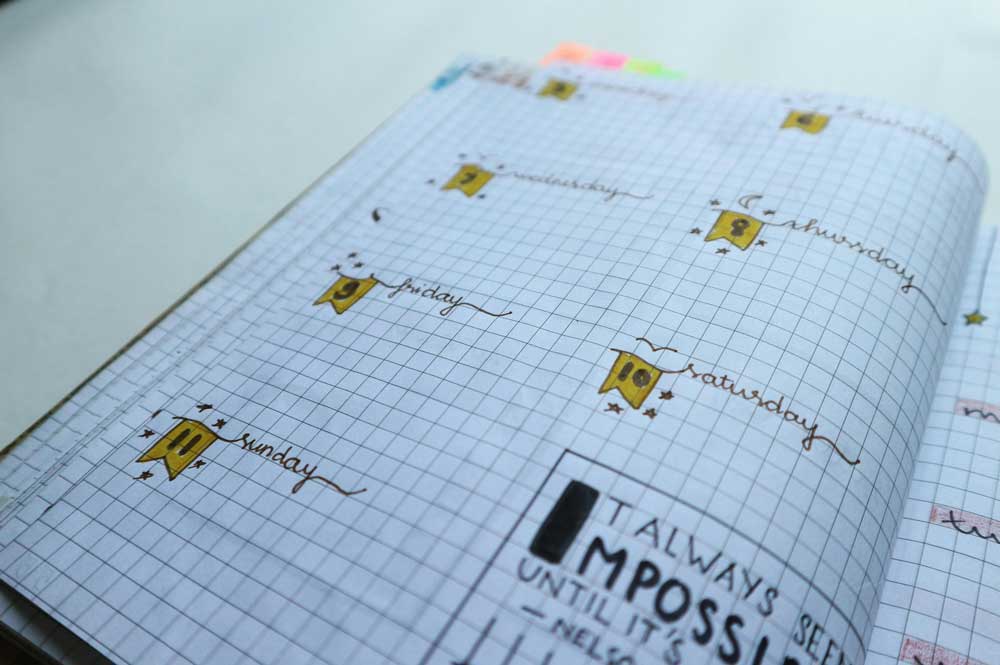

Track Your Progress: Use a spreadsheet, app, or even a printable tracker to mark each week’s contribution. Visualizing your progress can be incredibly motivating.

Stay Flexible: If weekly contributions become difficult, adjust the amounts temporarily rather than abandoning the challenge altogether. The key is consistency over perfection.

Celebrate Milestones: Reward yourself when you hit smaller targets, like ₹10,000, ₹30,000, or ₹50,000. This can help maintain your enthusiasm throughout the year.

Pros and Cons of the 52-Week Savings Challenge

Pros:

Simplicity: The structure is easy to understand and doesn’t require complex calculations or financial knowledge.

Low Barrier to Entry: With contributions starting at a low amount, the challenge is accessible to people at nearly any income level.

Encourages Habit Formation: Saving each week helps establish a regular savings habit, which can lead to better financial discipline.

Customisable: You can adjust the amounts to suit your financial situation. For example, doubling the weekly savings can help you save ₹1,37,800 by year-end.

Engaging and Fun: The viral nature of the challenge, especially on platforms like TikTok, creates a sense of community and accountability.

Cons:

Heavier Contributions in Later Weeks: The escalating nature of the challenge can be daunting toward the end, especially during festival seasons when expenses are higher.

Limited Flexibility for Emergencies: If an unexpected expense arises, sticking to the weekly schedule might be difficult.

May Not Be Ideal for Larger Financial Goals: While ₹68,900 is a great start, it may not significantly impact larger financial objectives like buying a house or paying off substantial debt.

Risk of Burnout: Without proper planning, participants may feel overwhelmed or tempted to abandon the challenge midway.

Is It Right for You?

The 52-week savings challenge isn’t a one-size-fits-all solution, but it’s a fantastic way to kickstart a savings habit. If you’re new to saving or looking for a fun, structured way to grow your funds, this challenge could be just what you need. However, if you have larger financial goals or inconsistent income, you might need a more tailored approach.

As the challenge trends once again in 2025, fuelled by Gen Z creativity and social media’s viral energy, it’s clear that the 52-week savings challenge is more than just a fad. It’s proof that small, consistent steps can lead to meaningful financial progress. So, is it the answer to your financial woes? Try it out and find out!