When I received my very first paycheck, my mother had a timeless piece of advice for me: ‘Buy gold.’ Throughout my life, have witnessed her passion for gold, whether it was for a wedding, a festival, or any special occasion. The tradition of gold shopping was deeply ingrained in our family, but as I entered my early 30s, marriage wasn't on my immediate plan. In fact, I didn't have any plans to tie the knot in the next few years. That’s when someone told me about digital gold investment.

As time passed, I observed my friends following in the footsteps of our mothers. They were investing in gold jewellery and renting safe deposit lockers in banks to safeguard their precious possessions. The sight of my friend buying yet more gold jewellery for her future daughter left me pondering whether we needed to challenge this pattern.

I couldn't help but question the wisdom of continuing this age-old practice, particularly when it came to investment. It wasn't the most practical approach to growing one's wealth.

The challenges with investing in gold jewellery became apparent as I delved deeper into the topic with Chartered Accountant Abhay Asknani. ‘The resale value is a significant concern. Gold jewellery often incurs making charges, which amounts to a substantial portion of the purchase price. When you decide to sell your gold jewellery, these making charges are deducted, reducing the actual value you receive.’, Asknani said.

He says, ‘Moreover, gold jewellery isn't immune to wear and tear. Over time, it experiences a "weight loss," which doesn't refer to personal fitness but rather to the reduction in the gold's weight due to wear and tear. This further reduces the value when you decide to resell it.’

Given these drawbacks, I decided to explore alternative avenues for investment. After reading extensively on the internet, I came across the world of digital or electronic gold. It was a significant shift from the traditional path my family had followed for generations.

Digital Gold: An Innovative Way to Invest in the Precious Metal

Digital gold provides a modern alternative to traditional physical gold purchases. It allows individuals to buy gold online, with the equivalent amount being securely stored as physical gold in insured vaults. The minimum investment can be as low as one rupee, and customers have the flexibility to sell their digital gold holdings, whether in whole or in part, at prevailing market rates. All digital gold offerings are certified by the government, guaranteeing purity and minimising the risk of fraud. All digital gold offerings are guaranteed to be 24K and government-certified, assuring purity and safeguarding against potential fraudulent activities.

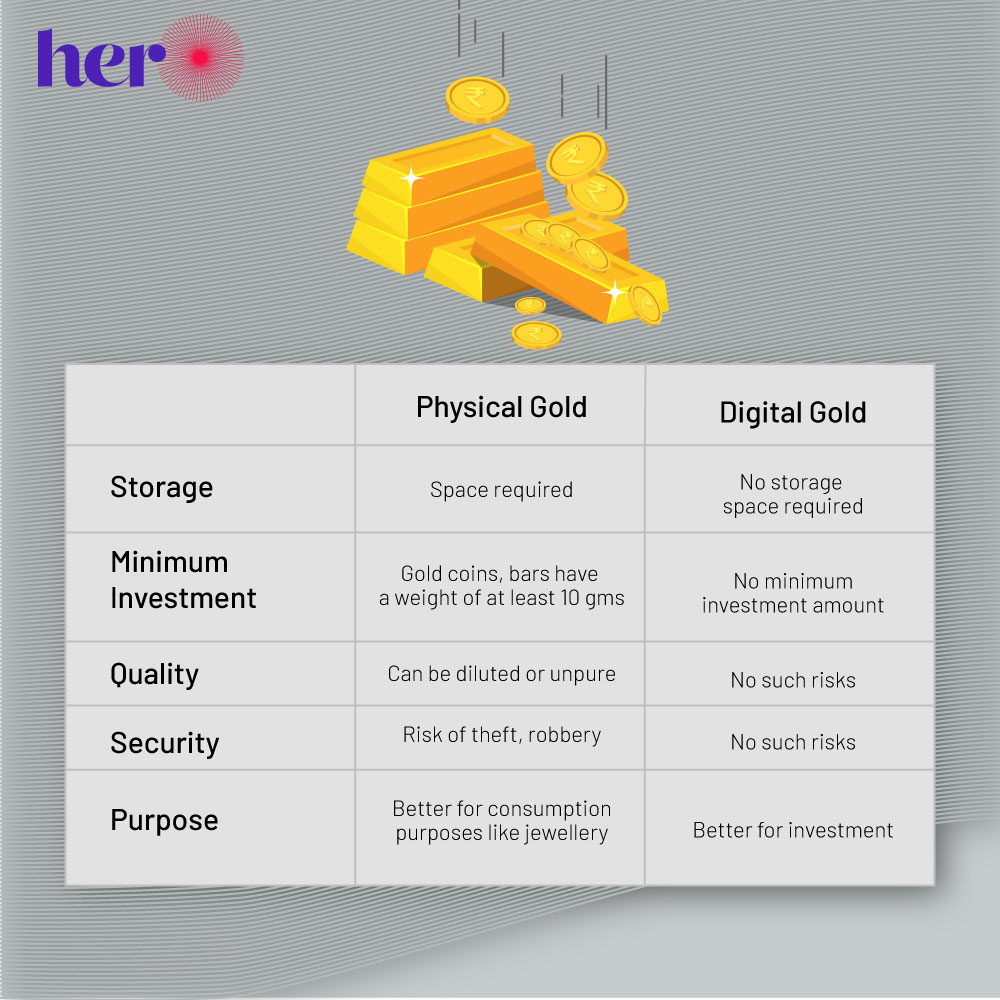

Asknani further says that both physical gold and digital gold are good options depending upon the requirements of an investor.

‘Both physical gold and digital gold present viable choices based on an investor's specific needs. Physical gold remains the preferred form for personal adornment, while digital gold stands out as the superior option for financial objectives. If the primary aim is gold investment, opting for digital gold proves advantageous over the physical counterpart. Digital gold offers cost-efficiency eliminates storage concerns, and offers effortless redemption.’ He adds.

He also sheds light on how digital gold is unregulated but is safe as an RBI-regulated trustee backs the gold, and the vaults are insured against theft and natural disasters.

‘Digital gold involves customers buying gold digitally, and an equivalent amount is securely stored in insured vaults, backing the digital gold. This means that there is no price difference between physical and digital gold. Additionally, individuals investing in digital gold don't need to worry about a lot of other factors that come with physical gold’ he adds.

Advantages of Digital Gold:

• Easy to Buy: Purchasing digital gold is incredibly convenient. You can invest as little as Rs 10 with just a few clicks on an app, all from the comfort of your home. This accessibility allows for periodic micro-investments, helping you save over time.

• Purity: Digital gold is always 24K 999 pure gold and NABL BIS certified, ensuring consistent and guaranteed purity.

• Hassle-Free Liquidity: Digital gold investments come with no lock-in periods, allowing you to withdraw your digital gold as cash or have the equivalent amount of physical gold delivered to your doorstep whenever you choose.

• Secure Storage: One of the most significant advantages is the secure storage provided by digital gold providers. Your purchased gold is stored in insured vaults, eliminating the need for a personal safe deposit box and concerns about theft or loss.

• No Lower Limit on Investment: There is no minimum investment requirement. You can invest any amount you desire, including as little as one rupee.

• Use as Collateral: Digital gold can be used as collateral for loans. Its high purity and secure storage make it an attractive option for lenders and borrowers alike, simplifying the borrowing process.

• Ease of Exchange: You can easily exchange digital gold for physical gold, coins, or bullion at any time and from anywhere. This flexibility allows you to access your physical gold assets conveniently.

• Genuineness: Digital gold maintains 24K purity, offering buyers peace of mind regarding authenticity. The risk of fraud is significantly reduced, ensuring that purchasers receive the value they paid for.

However, it's essential to acknowledge the potential drawbacks associated with digital gold investments:

Risks of Digital Gold:

• No Regulatory Body: Digital gold lacks regulatory oversight, leaving it susceptible to unscrupulous practices. The absence of a regulatory authority creates grey areas that could be exploited by dishonest actors in the ecosystem.

• Storage Time Limit: Some platforms that offer digital gold impose storage time limits. After the expiration of this period, individuals must either withdraw the gold or sell it.

• Upper Limit of Investment: There is an upper limit on the amount you can invest in digital gold, which is currently capped at a maximum of 2 lakhs on most platforms. This may not be suitable for investors seeking to make substantial investments.

Who Sells Electronic Gold?

In India, three authorized entities offer digital gold investments:

1. MMTC PAMP India Pvt. Ltd.

2. Augmont Goldtech Ltd.

3. Digital Gold India Pvt. Ltd. (SafeGold)

These entities have the necessary licenses to provide digital gold investment options in the country, giving investors a trusted platform to explore this innovative way of investing in gold.

We recommend you to consult an expert before investing in digital gold.